Listed below are most other spending words to help you get beyond the principles. Yet not, efficiency in these profile you are going to be less than the newest long-name come back you would secure paying — inside an atmosphere which have higher interest rates including we are currently sense. And if you are alarmed that your particular deals might not keep up with rising cost of living, Zigmont says to remember the work you assigned to that cash, which is getting there when you need it and not secure a top go back.

The present day industry condition is facts one their “tortoise” investing approach is the best one to help you strengthening long-identity wealth, he said. Time provides turned-out tough this season, which have eight weeks bookkeeping for everybody of the S&P 500’s gains, considering DataTrek. Highest rates provides slammed technical and you may progress carries, which reigned over shopping traders’ portfolios in the pandemic. GameStop, the initial meme change, are off approximately 85percent from the all-date large. Such as, an excellent Treasury thread otherwise AAA-ranked corporate thread is a very lower-chance investment. However, this type of will pay seemingly low interest rates.

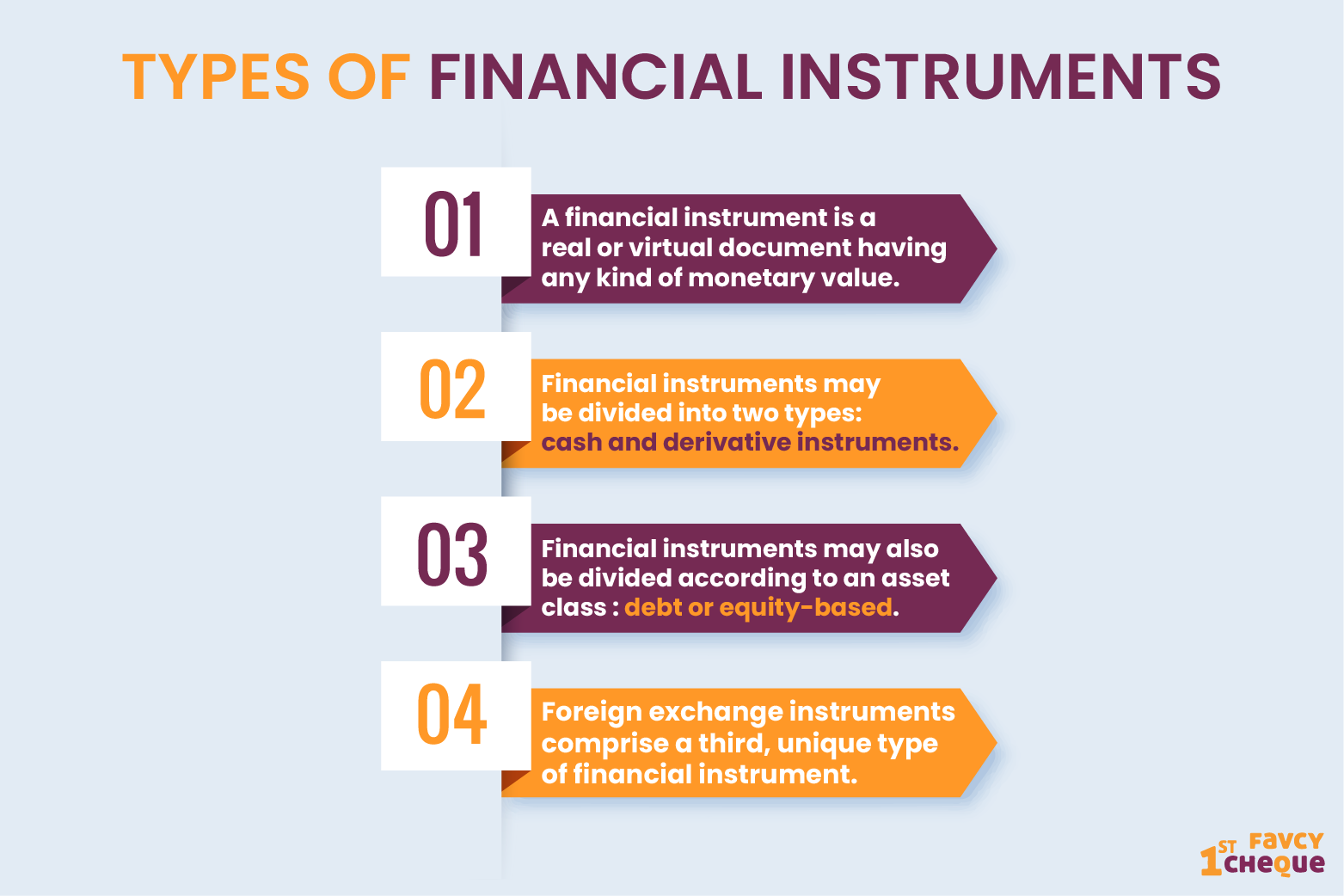

Rather, investors buy commodities using futures and you may alternatives contracts. You could purchase products via almost every other securities, such ETFs or purchasing the offers away from businesses that generate commodities. Unlike buying and selling holds, dividend people hold holds and you will make the most of the fresh bonus earnings. All of the investment possess some quantity of risk as well as the marketplace is volatile, it moves down and up over the years. It’s important about how to know yours risk tolerance.

In case your boss offers a pension package, including an excellent 401(k), spend some lower amounts from the spend until you increases the financing. If your company gets involved inside complimentary, you could know forget the provides doubled. Perhaps the common is brings, bonds, a house, and ETFs/mutual fund. Other types of opportunities to consider are a house, Cds, annuities, cryptocurrencies, commodities, collectibles, and you may gold and silver. There are even shared finance one to purchase only inside firms that adhere to specific ethical otherwise environmental values (aka socially in charge money).

The way to dedicate hinges on yours choice along together with your latest and you will coming monetary points.

Begin Investing Very early, Keep Spending Frequently: Dotbig Review

Deciding just how much risk to adopt when using is known as gauging your risk threshold. For individuals who’re also confident with far more quick-term pros and cons on the funding really worth for the chance of higher a lot of time-identity production, you actually has higher risk endurance. Concurrently, you could potentially feel great that have a slowly, much more moderate rate out of come back, with fewer good and the bad. Futures and you may alternatives paying appear to comes to exchange that have currency you borrow, amplifying their possibility losses.

“The newest meme stock occurrence seemed very focused on getting very plugged in the profile and you can keeping track of your assets — We comprehend the Bogleheads’ philosophy to be antithetical to all away from one to.” To the meme-stock rally in the rearview reflect and you can rates of interest flooding, individual buyers are rediscovering the new philosophy produced popular by the Vanguard’s inventor, Jack Bogle. The father of directory using preached lowest-costs, couch potato investments you to definitely substance more than decades. Admirers call by themselves “Bogleheads,” plus the method “lazy” spending. Really economic coordinators recommend an excellent count for a crisis money is enough to protection half a dozen months’ property value costs. You will want to know what do not imply because of the effective spending.

People is independently purchase without any assistance of a good investment elite group otherwise join the services of a licensed and Dotbig Review you will entered investment advisor. Technology also has provided traders a choice of getting automated funding choices thanks to roboadvisors. Inside the 2001, the new failure out of Enron grabbed cardiovascular system stage, with its complete screen away from ripoff one bankrupted the company and you can their accounting firm, Arthur Andersen, in addition to lots of their buyers. This type of fund consist totally of your own holds present in a particular directory. It pays to search to, and not simply to determine minimal places. Someone else could possibly get keep your charges down, such as trade charges and you can membership administration costs for those who have an equilibrium above a specific endurance.

To shop for offers of stock will provide you with partial ownership of a friends and allows you to take part in the gains (plus the loss). Some stocks as well as be worthwhile, that are small regular costs out of companies’ payouts. A market list is various assets one depict a portion of the business. Such as, the fresh S&P five hundred is actually market list you to retains the new holds from about 500 of the prominent enterprises in the U.S. An S&P five hundred index finance perform aim to reflect the brand new performance from the brand new S&P 500, buying the carries in this directory. Of several savers prefer with people invest their money for them.

Which’s very good news, since the paying might be a great way to construct your wide range. We’lso are frequently viewing groups using lots of terms about their tech, but when you indeed view the company’s unit, there isn’t any basic technical development. Even with the way you like to dedicate or that which you choose to buy, search your own target, and your financing manager or system. Perhaps one of the recommended nuggets of expertise is actually away from experienced and you may completed buyer Warren Meal, “Never ever purchase a corporate you can not understand.” Investing is different from protecting because the money put is placed to function, meaning that there is certainly some implicit risk the related venture(s) get falter, causing a loss in money.

Through the years, it will slower shift a few of your money to the ties, following general rule you want when planning on taking some time reduced exposure since you means old age. You might open many types of low-retirement profile from the an online agent. Knowing your aims, you can dive to the facts on how to purchase (out of selecting the sort of membership to your number 1 place so you can open a merchant account so you can opting for funding auto).

According to Jay Zigmont, a liquid Valley, Mississippi-based official monetary planner and maker away from ChildFree Wealth, you can consider this to be since the “job” you assigned to your bank account. And you may, as with lifetime, you’ll find some other products a variety of efforts. It’s according to the full of a good fund’s property under administration. The fresh MER vary out of 0.05 per cent in order to 2 percent a year.

In this article, our company is mainly centering on using for very long-name needs. We’ll along with touch on simple tips to invest without particular purpose in your mind. After all, objective to expand your money is an excellent mission by itself. Your investment approach utilizes your saving wants, the amount of money you should reach them plus go out horizon. “People are strengthening long-label profiles for the Robinhood, capitalizing on the better economics and the systems to complete you to definitely.” Actually in the greater types of holds and securities, there is grand differences in risk.

- That’s titled advantage diversity, as well as the proportion from dollars you add on the for each and every asset category is named advantage allowance.

- There are also shared money you to definitely purchase entirely inside the firms that conform to particular moral otherwise environment values (aka socially responsible money).

- The response to one question often choose whether or not you’re saving otherwise paying.

- The brand new twenty-first 100 years along with opened the world of spending to newbies and you can bizarre people by the flooding industry having discount online financing companies and you can 100 percent free-trading software, such as Robinhood.

- You could install automatic transfers from your own bank account to help you disregard the membership, if you don’t right from their salary in case your boss allows you to.

You can buy ETFs otherwise shared finance one to song a specific stock index or seek to do an industry-conquering collection. Or, you can discover a merchant account having a great robo-coach in order to automate the process and possess exposure to brings rather than in need of a huge amount of education to get going. Such as, when you yourself have a relatively high risk tolerance, and also the time and wish to research private carries (and understand how to still do it), that might be the way to go.

Finance for example ETFs and shared financing enable you to spend money on several otherwise a huge number of property at once once you buy the offers. This easy diversification produces shared money and you will ETFs essentially much safer than individual assets. Using is the process of to shop for assets one to boost in value over the years and supply productivity when it comes to earnings payments or money development. Inside the a much bigger sense, spending can also be on the spending time otherwise money to alter your lifestyle and/or life away from anyone else. But in the world of finance, using ‘s the acquisition of securities, a home or other items of well worth from the pursuit of money gains otherwise income. Spending is the work of publishing resources on the something to build earnings or get earnings.

As to why paying is essential

The brand new money dangers various other correction experience today as the rising prices get… Gordon Scott might have been an energetic buyer and you may technical expert otherwise 20+ ages. It’s such as a great runaway snowball of cash growing big and you may huge as it goes collectively.

Each type away from investment has its own amount of exposure, however, that it chance can be correlated that have productivity. How to purchase your money ‘s the method in which works well with your. To work one aside, you’ll want to think about your spending design, your financial budget, along with your chance endurance. Using your finances is going to be a very credible way to build money over time. If you are an initial-date individual, our company is here to help you get started.

Securities are debt obligations out of agencies, such as governing bodies, municipalities, and you can organizations. To purchase a bond means you own a portion from a keen entity’s financial obligation and they are eligible to receive occasional desire money and you can the fresh get back of the bond’s face value when it develops. A buyer out of a good businesses stock will get a fractional proprietor out of one company. Owners of a good organization’s stock have been called the investors and you can can be take part in the growth and you may achievement due to enjoy on the stock speed and you will normal returns paid out of your business’s earnings. What’s incorrect which have merely to experience it safer with all pension money and you will remaining it in the bucks? Once you perform, you’ll getting well-positioned for taking advantage of the newest ample prospective you to definitely brings have to prize your economically over time.

How to Purchase Currency: Discovering the right Solution to Invest to you personally

Exchange-traded finance let a trader buy loads of stocks and bonds at once. Basically, inactive using concerns placing your bank account to be effective in the funding vehicle in which someone else has been doing the tough work. For example, you could hire a monetary otherwise funding advisor — otherwise fool around with a great robo-mentor to build and apply a good investment strategy in your stead.

A real house money trust (REIT) is a family you to spends inside and handles a property to help you push payouts and develop income. With step one,000, you might purchase REIT holds, shared finance, otherwise exchange-exchanged finance. Including list financing, ETFs incorporate big money from investment that may vary from holds in order to bonds to currencies and cash. The good thing about a keen ETF would be the fact it positions for example a great stock, which means that investors can purchase them for a percentage speed you to is usually less than the fresh 500-along with lowest financing of numerous shared financing need. Full-solution agents offer an over-all selection of economic functions, and monetary advice about senior years, medical care, training, and a lot more.

Merchandise is precious metals, petroleum, grain, and creature points, and financial tools and you will currencies. They could be replaced due to commodity futures—which happen to be plans to find otherwise offer a certain amount of an item from the a specified speed for the a certain coming go out—or ETFs. Commodities can be used for hedging risk or for speculative objectives.

Determine The Threshold to have Chance

If you own a common finance (in your 401(k), such) following — done well! If you start paying now, you could allow your savings bucks hitch a trip within the a great auto you could keep for years and have it maybe be much more worthwhile than just when you become. Many creditors provides minimum put standards. To put it differently, they acquired’t undertake your account application if you do not deposit a specific amount of cash. You additionally is always to remember that zero investment is actually guaranteed, but calculated risks pays from.

That’s as to why to find commodities is usually for more educated people. A person is Acorns, and therefore rounds enhance purchases for the linked debit or credit cards and invests the change in the a varied portfolio away from ETFs. On that prevent, it really works such as a great robo-coach, handling one collection for you. There’s no lowest to open an Acorns account, and the provider may start paying for you once you’ve collected at the very least 5 inside the bullet-ups.

Investing in addition to differs from conjecture in this for the second, the money is not applied for every-se, but is playing for the quick-name speed action. Since the attention begins to accumulate on your investment, it’s added to your own baseball of cash. You continue to secure focus, what you owe expands inside the well worth and you will registers rate — and on as well as on it goes.

What’s Paying? How do you Start Spending?

Robo-advisors largely build its profiles from reduced-prices ETFs and you can list financing. As they render lower will cost you and you will lowest or no minimums, robos enable you to begin quickly. It charges a little commission to possess profile administration, fundamentally up to 0.25percent of your account balance. Owning a home Trusts (REITs) are one of the top in this class.

Mainly due to this, more actively addressed common finance indeed underperform the standard directory. Most agents charges customers a fee for each trading. Because of percentage can cost you, people basically see it sensible in order to reduce final amount away from trades which they generate to quit spending more cash to your costs. Specific other kinds of assets, such change-exchanged finance, hold costs to help you shelter the costs away from money management. Strengthening an excellent varied collection away from individual carries and ties will take time and you can possibilities, very very people make use of financing spending.

After you’ve made a decision to dedicate, your next steps rely on debt needs and you will if you need to open a free account. Choices trade entails high chance which is not suitable for all the buyers. Prior to trade possibilities, please realize Functions and you will Dangers of Standardized Options. Help files for claims, when the appropriate, would be equipped up on demand. Buyers make virtual trades as if they certainly were paying with real currency. Through this process, simulation pages have the opportunity to learn about spending—and to experience the consequences of its virtual financing choices—rather than placing their own money on the newest line.

It means evaluating exactly how comfy you are with chance or how far volatility you might deal with. Directory financing can have minimal money conditions, many brokerage organizations, in addition to Fidelity and you may Charles Schwab, provide a variety of list money without lowest. This means you can start investing a collection money to have below one hundred. Learning how to invest money begins with deciding your own investing requirements, if you want otherwise have to get to her or him along with your spirits top with chance for every purpose. When you are investing for the next goal, your most likely do not want old age profile — that are made to be taken for later years, and possess constraints on the when as well as how you could bring your money back away.

Because the a beginner, investing is voice intimidating — however, by the goal setting techniques and you may a period views, you possibly can make they simpler. When you are looking for spending, old age preparations, robo-advisers, finance and funding software are common towns to look at. However, including mutual finance, traders within the list finance is to shop for an amount of one’s business in one single purchase.